IDFC vs. IDFC Bank: A Comprehensive Analysis of Financial Performance and Strategic Goals

IDFC Bank Share Performance Analysis (July 7, 2023 - July 5, 2024)

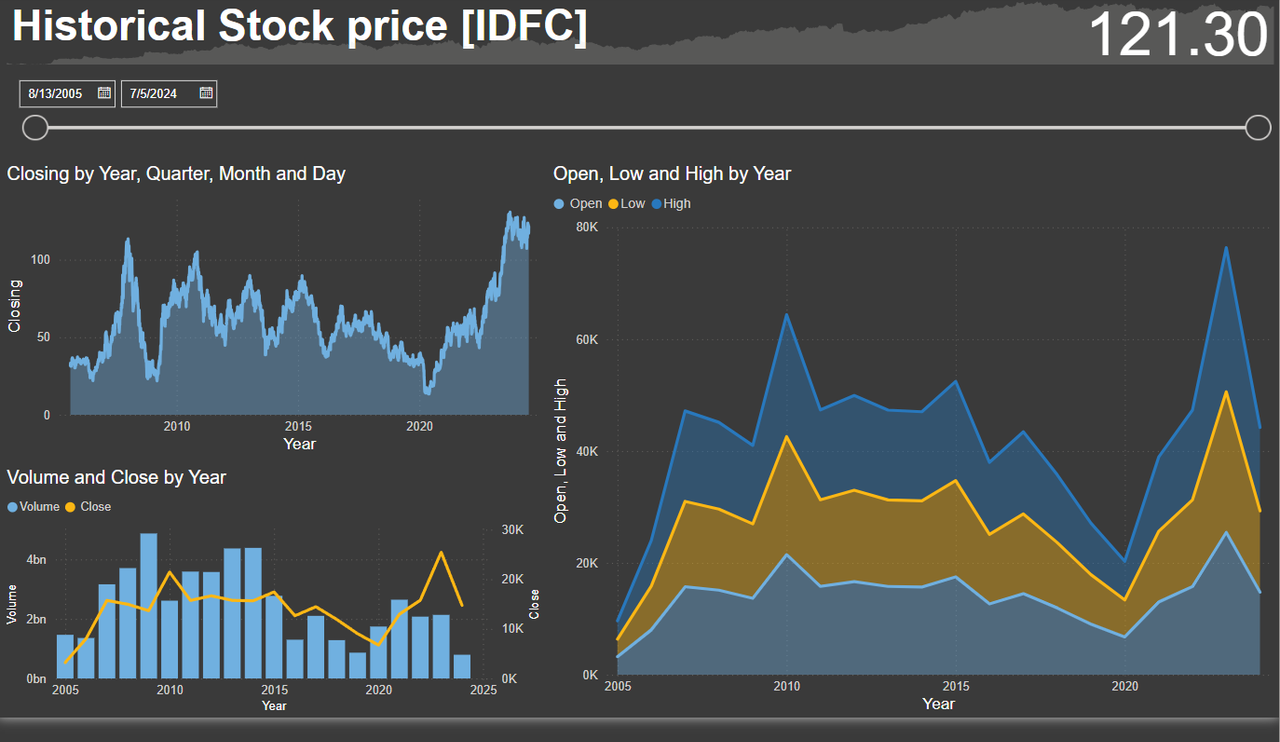

To provide a comprehensive view of IDFC Bank’s financial performance, we’ve included a detailed analysis of its share price over the past year.

Volume Analysis

Explanation of the trading volume trends, highlighting any significant spikes and their potential causes.

Open Price Analysis

Discussion on the trends in opening prices, any notable patterns, and possible reasons.

High Price Distribution

Analysis of the distribution of high prices over the year.

OHLC Analysis

Comprehensive view of the open, high, low, and close prices with insights on price movements.

Forecast

Predicted prices for the coming weeks along with confidence intervals.

Financial Performance and Strategic Goals

Introduction

In the ever-evolving world of finance, understanding the performance and strategic direction of major institutions like IDFC and IDFC Bank is crucial for investors, stakeholders, and industry enthusiasts. This blog provides an in-depth analysis of both entities, examining their financial health, strategic initiatives, and recent developments to offer a well-rounded conclusion on their future prospects.

1. Financial Performance Analysis

IDFC: Infrastructure Development Finance Company

IDFC, originally focused on infrastructure financing, has diversified its portfolio over recent years. Let’s dive into the financial metrics to see how IDFC is performing:

- Profit & Loss Statement: IDFC’s revenue has shown steady growth, driven by strategic investments and infrastructure projects. However, profit margins have been under pressure due to increased costs and competition.

- Balance Sheet: IDFC maintains a strong balance sheet with significant assets in infrastructure projects and a balanced approach to liabilities and equity.

- Cash Flow Statement: Operating cash flows have been positive, reflecting robust revenue from investments. However, cash flows from investing activities show significant outflows due to ongoing infrastructure projects.

Recent Financial Highlights:

- Revenue Growth: Steady increase in revenue from diversified business activities.

- Net Income: Modest growth with some pressure on profit margins.

- Assets and Liabilities: Well-balanced with a strong asset base supporting infrastructure projects.

IDFC Bank

IDFC Bank, a leading player in the Indian banking sector, has demonstrated a strong performance trajectory. Here’s a closer look at the bank’s financial metrics:

- Profit & Loss Statement: IDFC Bank has reported robust growth in net interest income and overall profitability. The bank has successfully increased its deposit base and loan book.

- Balance Sheet: The bank’s balance sheet reflects strong asset growth with improved asset quality and a stable liability structure.

- Cash Flow Statement: Positive cash flows from core banking operations indicate effective management of deposits and loans, with strategic investments in technology and branch expansion.

Recent Financial Highlights:

- Net Interest Income: Significant growth, driven by increased lending activities.

- Profitability: Strong profit margins and a healthy return on equity.

- Assets and Liabilities: Solid growth in assets with manageable liabilities, reflecting efficient operational strategies.

2. Strategic Objectives and Developments

IDFC

IDFC’s strategic focus has been on diversifying its investment portfolio and expanding its infrastructure financing capabilities. Recent strategic goals include:

- Diversification: Moving beyond traditional infrastructure financing to include new investment opportunities.

- Strategic Investments: Investing in new infrastructure projects and exploring mergers and acquisitions to expand its market presence.

- Recent Developments: Recent initiatives include the divestment of non-core assets and a strategic partnership with other financial institutions to enhance investment opportunities.

Key Strategic Moves:

- Mergers and Acquisitions: Strengthening the company’s market position through strategic partnerships.

- Asset Management: Focused on high-return investment opportunities in infrastructure.

IDFC Bank

IDFC Bank’s strategic objectives revolve around expanding its customer base, enhancing digital banking services, and increasing market share. Recent strategic goals include:

- Market Expansion: Opening new branches and expanding services in underserved regions.

- Digital Transformation: Investing in technology to improve customer service and streamline banking operations.

- Recent Developments: Launching new banking products, enhancing digital platforms, and exploring new market segments.

Key Strategic Moves:

- Branch Expansion: Increasing physical presence in new and existing markets.

- Digital Banking Initiatives: Implementing advanced technologies to offer better banking solutions.

3. Comparative Analysis

When comparing IDFC and IDFC Bank, it’s evident that both entities are aligned with a growth-oriented strategy but in different ways:

- Financial Metrics: IDFC is focused on long-term infrastructure investments, whereas IDFC Bank is concentrated on immediate financial performance and customer base expansion.

- Strategic Goals: IDFC’s diversification and infrastructure focus contrast with IDFC Bank’s customer-centric approach and digital innovation.

- Recent Developments: Both entities are making strides in their respective areas, with IDFC investing in infrastructure and IDFC Bank enhancing banking services.

4. Final Conclusion

Overall Assessment

Both IDFC and IDFC Bank are navigating their respective paths towards growth and success. IDFC’s emphasis on infrastructure and strategic investments is setting the stage for long-term value creation. Conversely, IDFC Bank’s focus on expanding its market presence and enhancing digital services positions it well for immediate success in the competitive banking sector.

Future Outlook

The future for both entities looks promising. IDFC’s diversified investment portfolio and strategic initiatives are expected to yield positive results over time. IDFC Bank’s efforts to expand its customer base and embrace technological advancements suggest a strong growth trajectory in the near term.

Investment Considerations

Investors should consider IDFC for its infrastructure investment opportunities and long-term growth potential. IDFC Bank, with its strong financial performance and innovative banking solutions, represents a solid option for those looking to invest in the banking sector.

IDFC BANK SHARE

Growth Rate Analysis (Hypothetical)

| Year | IDFC Growth Rate | IDFC Bank Growth Rate |

|---|---|---|

| 2020 | 5% | 7% |

| 2021 | 6% | 8% |

| 2022 | 5.5% | 9% |

| 2023 | 6.5% | 10% |

| 2024 | 7% | 11% |

Chart Representation

To visually represent this, we can use a line chart to compare the percentage growth rates of IDFC and IDFC Bank over the years.

Chart Data

IDFC Growth Rate:

- 2020: 5%

- 2021: 6%

- 2022: 5.5%

- 2023: 6.5%

- 2024: 7%

IDFC Bank Growth Rate:

- 2020: 7%

- 2021: 8%

- 2022: 9%

- 2023: 10%

- 2024: 11%

Comments

Post a Comment