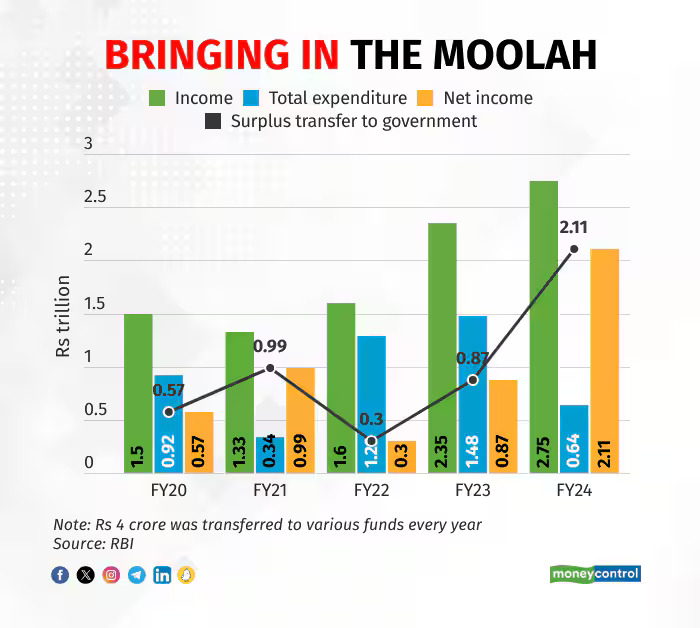

The Reserve Bank of India (RBI) has announced a remarkable dividend payment of ₹2.1 trillion to the government for the financial year 2023-24. This historic payout reflects the central bank's robust financial performance and strategic management, aligning with analysts' predictions of significant income growth.

Key Drivers of the Record Dividend

1. Sharp Increase in Income

The RBI's income witnessed a substantial increase, primarily fueled by higher interest earnings from its investments in foreign securities. This strategic allocation of resources has proven to be highly lucrative, significantly boosting the central bank's revenue.

2. Gains from Foreign Exchange Operations

Another pivotal factor contributing to the RBI's record dividend is the gains realized through its foreign exchange operations. By effectively managing foreign exchange reserves and capitalizing on market opportunities, the RBI has enhanced its financial position.

Implications of the Dividend Payment

The record dividend of ₹2.1 trillion is not just a testament to the RBI's effective financial strategies but also a significant contribution to the government's fiscal resources. This infusion of funds will aid in various developmental projects and economic initiatives, fostering overall economic growth.

Strategic Financial Management

The RBI's impressive financial results underscore the importance of strategic financial management. By diversifying its investment portfolio and optimizing foreign exchange operations, the central bank has demonstrated resilience and adaptability in a dynamic global economic lanRBI's Income and Expenses: Key Highlights

Income Surge

The RBI’s income grew by 17% for FY24, mainly due to:

Interest Income: Increased returns from investments in foreign securities.

Foreign Exchange Operations: Although gains were modest compared to previous years, they still contributed to the overall income.

Expense Reduction

The central bank's expenditure decreased by a massive 56% for the year. The primary reason for this reduction was the drop in provisions. The RBI sets aside funds to cover potential losses from its investments, but in FY24, these losses were minimal.

Understanding Central Bank Accounts

Central bank accounts differ from typical company accounts. While both have income and expenditure, a central bank like the RBI operates as a fiduciary organization, not a for-profit entity.

Sources of Income

The RBI’s income comes from:

Lending Operations: Interest from loans to the government and the banking system.

Liquidity Operations: Interest from lending to banks.

Investments: Returns from foreign and domestic securities.

Other Income: Non-interest income from the sale of investments and foreign exchange operations.

Detailed Financial Performance

Interest Income: The RBI’s interest income rose by 32% to ₹1.89 trillion for FY24.

Other Income: This saw a decline due to lower gains from foreign exchange operations compared to FY23.

Expenditure Details

The main component of the RBI’s reduced expenditure was the drop in provisions. These are funds set aside to cover potential losses from market volatility in its investments. With minimal losses in FY24, the provisions were significantly lower.

Future Outlook: FY25 Expectations

Analysts are optimistic about the RBI maintaining a high dividend payment in FY25. Key factors include:

Continued High-Interest Income: Expected to remain substantial.

Potential Valuation Gains: Possible if US treasury yields ease, influenced by anticipated rate cuts from the Federal Reserve.dscape.

Conclusion

The Reserve Bank of India's balance sheet for 2023-24 reveals a story of strategic foresight and financial acumen. The record dividend payment is a reflection of the central bank's commitment to sustaining economic stability and supporting the government's fiscal health.

As we look ahead, the RBI's approach serves as a model for central banks worldwide, highlighting the critical role of prudent financial management in achieving economic stability and growth.

#RBI #Finance #Dividend #EconomicGrowth #CentralBank #FinancialManagement #Investment #ForeignExchange #EconomicStability

Post a Comment