Indian Public Sector Units (PSUs) Drive Record Profit Growth

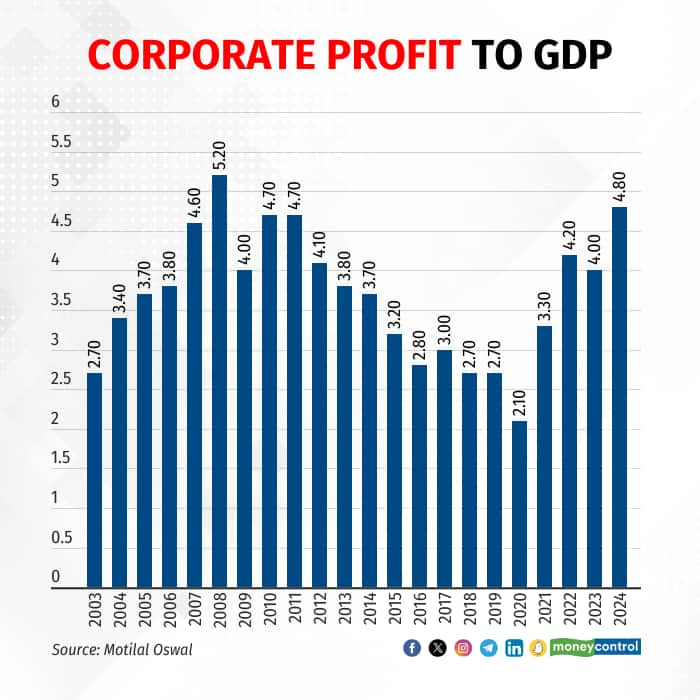

The recent financial performance of Indian Public Sector Units (PSUs) has been nothing short of spectacular, marking a fivefold increase in profit from ₹1 lakh crore to ₹5.2 lakh crore between FY20 and FY24. This robust growth has significantly contributed to the overall profit-to-GDP ratio, which has reached a 15-year high.

Key Highlights:

- Profit Surge: Indian PSUs have seen profits multiply fivefold, playing a pivotal role in boosting the overall profit-to-GDP ratio.

- Sector Contributions: The Banking, Financial Services, and Insurance (BFSI) sector alone accounted for 36% of the profit growth.

- Corporate Contribution: The Nifty-500 companies, representing 91% of India's market capitalization, now contribute 4.8% to GDP. Including all listed companies, this figure rises to 5.2%.

- Growth Trends: Corporate profits for the Nifty-500 grew 30% year-on-year (YoY) in FY24, following a 9.3% YoY growth in FY23.

- Sectoral Performance: While BFSI, Oil & Gas, and Automobiles saw growth, Metals, Technology, and Chemicals experienced declines.

- Historical Context: The profit-to-GDP ratio peaked before the financial crisis, dropped to a low during the pandemic, and has now rebounded to 4.8% in 2024, above the long-period average of 3.7%.

A Closer Look at the Numbers

Public sector companies have significantly driven the recent surge in profits. The private sector's profit-to-GDP ratio, which improved from 0.8% in 2003 to 2.8% in 2008, contracted to 1.4% in 2020 but has recovered to 2.7% in 2024. Meanwhile, the public sector's remarkable performance has pushed the overall profit-to-GDP ratio to new heights.

Economic Outlook

The future looks promising for the Indian economy. According to Motilal Oswal, several factors suggest that the high profit-to-GDP ratio will be sustained:

- Real GDP Growth: Projected at 8.2% for FY24.

- Inflation: Expected to remain around 5%.

- Fiscal and Current Account Deficits: Within manageable levels.

- Stable Currency and Government Policies: Supportive of growth.

Conclusion

With favorable economic conditions and strong performance from key sectors, India's corporate profit-to-GDP ratio is likely to remain robust. The post-election period brings renewed optimism for Indian markets, promising continued growth and stability.

Stay tuned for more updates and insights into the factors driving the Indian economy forward.

source: MoneyControl

Post a Comment