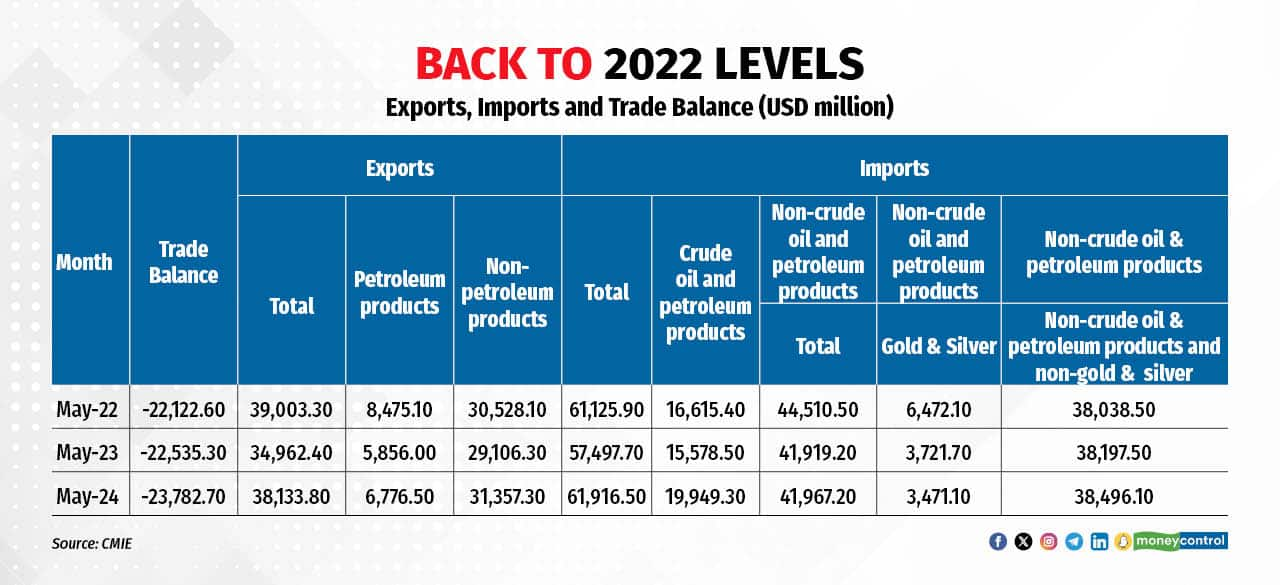

At first glance, India’s merchandise exports for May 2024 show promising growth, with a 9.07 percent year-over-year increase. This is the strongest growth since February, following two months of lackluster performance. However, a closer look reveals a more nuanced picture. Despite this growth, total exports in May 2024 reached USD 38.1 billion, still below the USD 39 billion mark achieved in May 2022.

Petroleum and Non-Petroleum Exports

A significant contributor to this year's growth has been the petroleum sector, with exports rising by 15.72 percent compared to a year ago. Non-petroleum products also fared well, growing by 7.73 percent, marking a two-month high. This is a positive sign, especially since non-petroleum exports are slightly higher than in May 2022, suggesting resilience and potential for further growth.

Import Trends and Economic Implications

On the import front, May 2024 saw a slight increase compared to May 2022, primarily driven by a sharp rise in crude oil imports. This rise occurred despite the higher crude prices in May 2022, due to the disruptions caused by Russia’s invasion of Ukraine. The increase in crude imports may indicate robust economic activity within India. However, non-oil, non-bullion imports saw a modest increase of just 1.2 percent from May 2022, reflecting cautious consumer and industrial demand.

Global Trade Outlook

The global trade environment remains challenging. According to the World Bank’s "Global Economic Prospects" (GEP) report, global trade is recovering, but the growth outlook remains subdued compared to recent decades. The World Bank estimates a 2.5 percent growth in world trade volume this year, a significant improvement from the 0.1 percent growth in 2023. However, several factors, such as trade-restrictive measures and elevated trade policy uncertainty, continue to dampen the trade outlook.

The GEP report highlights that despite the expected growth in trade this year, by the end of 2024, global trade is set to register the slowest half-decade of growth since the 1990s. This slowdown is attributed to subdued global GDP growth and a proliferation of trade restrictions worldwide. Moreover, the responsiveness of global trade to global output is likely to remain lower than pre-pandemic levels, reflecting muted investment growth.

Policy and Strategic Considerations

India's strategic policy direction will be crucial in navigating this complex trade environment. Several free trade agreements (FTAs) between India and other nations are in the pipeline. With the formation of the new government, there is hope that these agreements will be expedited, potentially boosting India’s trade prospects.

In the longer term, India's export strategy must capitalize on geopolitical shifts, particularly the West's Cold War stance against China. By positioning itself as a viable alternative to China in the global supply chain, India can attract more investment and trade partnerships.

Conclusion

While India's merchandise exports in May 2024 show signs of recovery, it is essential to recognize that they are merely back to the levels seen in 2022. The growth in non-petroleum exports is a positive sign, but the overall trade environment remains challenging. As global trade growth remains subdued, India needs to focus on strategic policy measures to boost its exports and leverage geopolitical shifts to its advantage. The journey ahead requires cautious optimism and strategic foresight to ensure sustained export growth and economic resilience.

Post a Comment